The benefits of connected thinking for accountants

This blog post explores the advantages of connected thinking for accountants in the realm of personal knowledge management (PKM).

We consume a lot of information

As accountants, we are constantly bombarded with information from various sources, whether it's new tax laws, accounting standards, or industry trends. With so much information coming at us, it's easy to feel overwhelmed and struggle to keep track of it all. This is where the concept of connected thinking and personal knowledge management (PKM) comes into play.

Connected thinking, as it relates to PKM, is the practice of organizing and linking information in a way that allows for easy retrieval and application. This concept is particularly relevant for accountants, who often need to access specific information quickly to answer client questions or make informed decisions.

One way to implement connected thinking in your own personal knowledge management is through the use of note-taking apps such as Obsidian or LogSeq. These apps allow you to create notes and then link them to other notes, creating a connected graph of all the different information you've collected. This not only helps you organize your thoughts and ideas but also allows you to quickly find relevant information when you need it.

How can you start implementing connected thinking and PKM in your own accounting practice? Here are a few actionable steps to get you started:

- Start by choosing a note-taking app that works for you. There are many options available, so take some time to research and find one that fits your needs and preferences. Logseq, Obsidian and Roam Research are popular options that were new-ish when I started my journey a few years ago. New apps like Capacities and Noteplan include connected note-taking and more. My suggestion: choose an option that lets you create notes in markdown format (.md). This will make it easier to switch to another app without losing a lot of your links.

- Create a system for organizing your notes: Once you have your note-taking app, develop a system for organizing your notes. This could be based on topics, clients, or any other relevant categories that make sense for your practice. For me, individuals (clients, peers, authors, etc.) have a page with an '@' prefix. Any topics and specific notes (SOPs, notes on a conference session, etc.) are also on their pages. This makes linking much easier later.

- Link your notes: As you create new notes, be sure to link them to other relevant notes. This will help you build a connected graph of information that you can easily navigate and reference when needed.

- Regularly review and update your notes: Make it a habit to regularly review and update your notes to ensure they remain accurate and relevant. This will also help reinforce your understanding of the information you've collected.

A high-level example

It might be hard to make sense of this without an example. So here goes nothing.

Microsoft Copilot is something I'm using more at work and learning more about from the great folks on Tax Twitter.

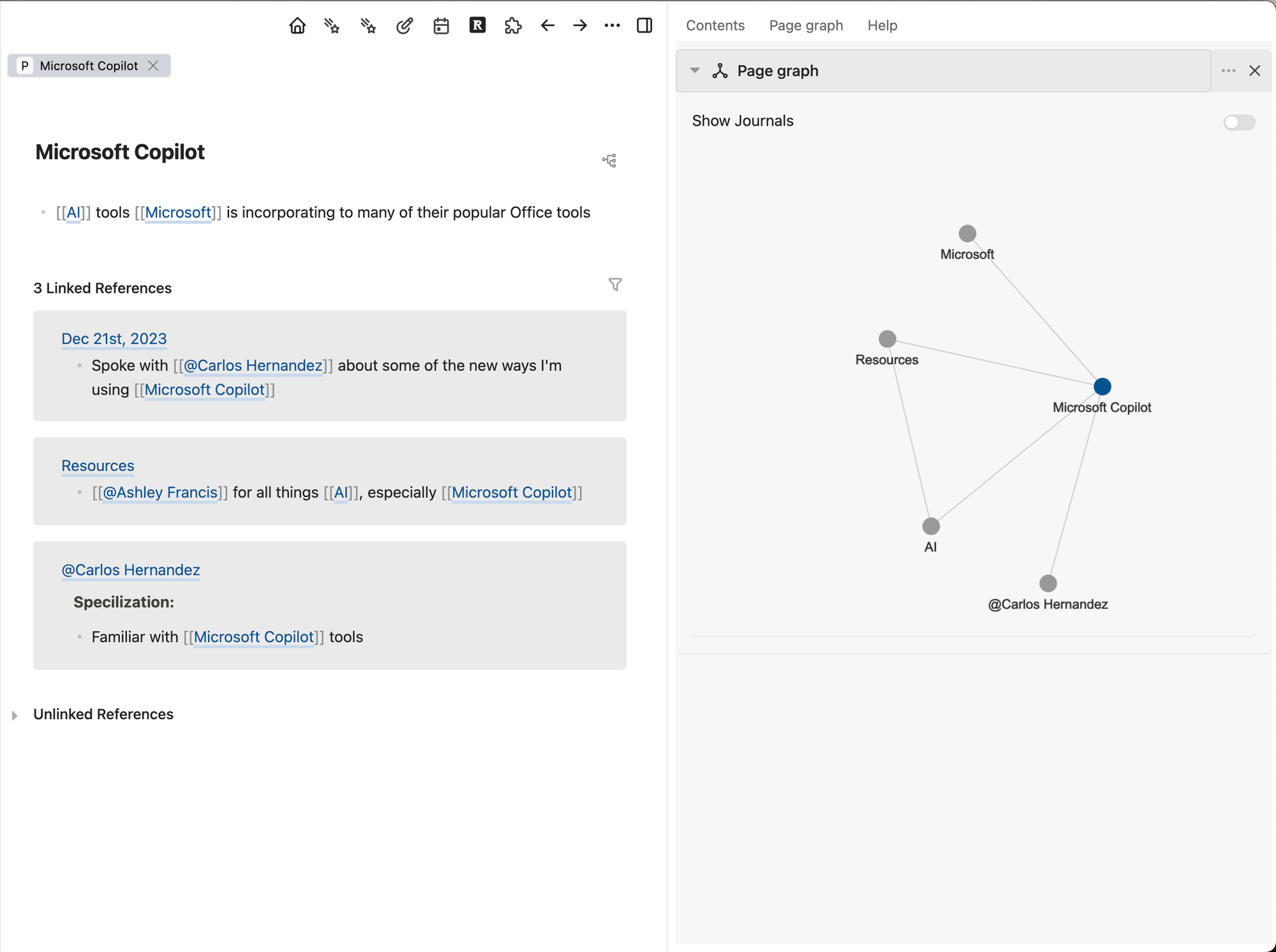

I have a note in Logseq called Microsoft Copilot. On that note, I have a brief description of what it is. The game changer? I can see all of the linked references to Microsoft Copilot. This means I have a one-stop shop to see everywhere I have mentioned Microsoft Copilot!

I'm using Microsoft Copilot, but this page could be about anything. Firm management, how to motivate and keep employees, SOPs for your practice.

By implementing connected thinking and PKM in your accounting practice, you can streamline your information management process and improve your ability to access and apply relevant information when you need it most. So, take the time to explore note-taking apps and develop a system for organizing and linking your notes. You'll be amazed at how much more efficient and effective you can be as an accountant when you embrace connected thinking.